Now that you understand that you need some real estate in your portfolio, should you invest in active or passive real estate?

You may have had a life-long dream to own and/or operate a real estate investment. While diving into active investing is outside the scope of this post, if you are reading this now, then you are likely extremely busy, and this may not be the best time for your family to start the active investing journey.

Or you might find it just is not that appealing once you know the truth about what it takes to stack the odds in your favor. It’s harder than it looks and it’s a steep learning curve. In fact, it takes just as much time and effort to master active investing as your current career!

If that is the case, passive real estate investing may be right for you. My mission is to help you assess that for yourself.

Building and running the largest independent real estate brokerage in Colorado, we completed thousands of deals each year and many of those were for investors. I had a front row seat to see what worked and what didn’t. Yet, with all my contacts and experience, I still could not find any simple, comprehensive reference guide to provide an orientation on passive investing and how to make the switch from active to passive.

My goal is to help a potential investor, with no prior experience, understand the basics of passive real estate investing, so you can decide if passive investing is right for you.

If you are already an active investor, then my goal is to help you make the transition to passive investor while retaining your tax advantages.

We will start by walking through common mistakes I have seen investors make over the years. I’ll provide some real-world examples to bring these to life and share some success stories, and some failures too, so you can learn from our triumphs and mistakes!

By the time you’ve read about my journey and experience here, you’ll have the confidence to know what questions you should ask as you start to evaluate investments and build your own passive portfolio.

As for active investing,

I have written several books on active real estate investing and I’ve pulled out this summary of each active investment category for you. It shows you exactly what it takes to potentially make a profit with each investment approach to give you an insider’s look into the industry.

To get a sense of which categories are best for your skills and personality, the second half of this appendix will have some questions to help you evaluate your skills. Many of the categories will not be a good fit for some investors, so this can help you save a lot of time.

Executive Summary of Real Estate Investment Categories:

- A summary of the categories of real estate investing. Each category is explored in much more depth in its individual chapter.

- Next, we review the skills, time, and monetary resources that you can devote to your real estate investments – this is “what you give.”

- Finally, we make some recommendations of which types of investments you might wish to consider, given your unique situation.

Types of Active Investments

Assignments. If you don’t have much equity (e.g., cash to use as a down payment), and/or if your credit power is limited, assignments can be a way to get started in real estate investing. You will need to have a strong “sales” personality to succeed at it, though.

Rental Condo or Rental Home. This is the purchase of a residential property to be rented out to tenants, usually on a 6–12-month lease term. This is how most new landlords get started. You may hire out all the property management functions, but in many cases, you will do many of them on your own. There are smaller down payment requirements for homes and condos than for larger rental buildings. The purchase process and financing process is very similar to what you experienced buying the home you live in now. It’s a great way for beginners to get started.

Small Apartment Building (2-4 units) to be rented to tenants, usually for 12-month terms. This is often what the rental condo or home landlords “graduate” to. In some markets they cost a little more than a rental home but are much more likely to generate positive cashflow. This results in less cashflow risk; if one unit is empty, you have other tenants that still help you with the mortgage payment, so it doesn’t all come out of your pocket. Many owners will start to delegate some of the property management tasks to an on-site assistant (typically the most responsible tenant), such as yard maintenance and showing empty units. The financing process is only slightly more involved than a residential loan. The purchase process is also very similar to purchasing a home. It is also a good way for beginners to get started.

Large Apartment Building (5 and more units). With five units and up you are still targeting tenants for 12 months at a time (buildings with more than five units are considered “commercial” property). The loans are somewhat more difficult to qualify for, and usually a larger down payment percentage is needed. Large apartment buildings are a less frequent choice for the new investor; this is usually what landlords with several years of experience “trade up” to. That said, we have had newbie landlords purchase 12-unit buildings and do very well. Cashflows on larger buildings are more stable than for smaller buildings, and the economies of scale make it practical (and desirable) to hire a property manager to take over most of the work for you. This reduces the hassle factor of the landlord process dramatically. If you are a busy professional that doesn’t need another hobby, this might be a good fit.

Fix and Flips involve purchasing a property that needs work. The scope can range from the basic “paint and carpet”, to extensive overhauls, to scraping a decrepit property and completely starting over. It usually does not involve tenants, and the objective is to get in and out of the property as quickly as possible. Great for beginners with the right skill set or the willingness to learn.

Conversion of Apartments into Condos are a synthesis of the fix and flip and rental operations – purchasing an apartment building in a neighborhood dominated by owner occupants, then converting the building from apartment building to condominium. Usually requires renovation of the units to meet the expectations of owner-occupant buyers in that area. Though complex and time consuming, condo conversions have wonderful tax advantages compared to fix and flips and often have superior returns to all other asset classes. Ideally suited for the sophisticated investor with extensive experience.

You need to be in the right phase of a market cycle for this to work. At the time of this writing, in most parts of the US, it’s not right time. It can be the right time if the apartment cost/SF (square foot) is at least $100 – $150 LESS than the price of a nice condo/ SF. Now, at least in Denver, apartments cost more $/SF than condos, so we’re a long way from this strategy being viable. That will change – it always does.

Scrapes, Pops and New Construction involve purchasing a small home in an expensive neighborhood that may or may not need work. The home is bulldozed, and a new home or duplex is put on the lot.

Alternatively, the existing home is renovated, and more square footage is added on. A pop-top is adding a second story to an existing home to add more square footage (commonly, a master bedroom suite). The investor that succeeds in this segment usually has quite a lot of real estate experience.

Passive Real Estate Investing. If none of this sounds appealing, the beginning part of this book is for you. Let someone who is full-time and experienced do the work, and just share some of the profits when the project is successful.

Assessing Your Skills and Resources

Let’s evaluate where you are now, and what you like to do, with eight criteria. Let’s begin by reviewing what the typical requirements are for successful investing in each investment category. You can compare those requirements to the self-assessment that you complete here to get an idea of how appropriate the investment class is for your current situation. This takes time and effort. Trust me, it’s worth it. We’ve seen hundreds of clients learn critical aspects of themselves and their investing potential by evaluating these criteria.

Equity Needed is how many liquid assets you and/or your investment team will need to have. Purchasing an apartment building, for example, usually requires at least 20% down on a purchase price that might start at $500,000, depending on the market. Realistically in Denver, you’d pay $150,000 – $200,000 per door, so a 12 unit might cost over $2 million. 25-30% is not uncommon for a downpayment. You would need $100,000 in cash just to get into the game for smaller rentals and $600,000+ for the twelve-unit building.

Credit Score will be important for some types of investments. Large apartment loans require nearly impeccable credit for the best terms. A small rental or fix and flip might require solid, though not perfect, credit. If you can put down 20%, you can often purchase a small rental even if your credit is far less than perfect. In general,

- If your credit score is under 620, you have poor credit.

- From 620 to 680 is average, and

- Above 680 would be good.

- 740 and above is great!

We’ll discuss the breakpoints for excellent, average, and poor credit in the “Where the Pros Get the Money” chapter and provide suggestions of how to improve your score.

Experience with Contractors will make some types of projects more pleasant. Fix and flips, as a category, benefit the most from this type of experience. We did not have much experience when we undertook our first projects and we still managed to muddle through (but we learned a lot on our first projects and made lots of mistakes). We have worked with many investors with the same experience. On the other hand, if you purchase a larger apartment building that already has a competent property manager in place, you will need less experience with contractors.

Experience with Property Managers makes purchasing a rental property easier. It certainly is not essential, and you can learn by doing. We’ll outline the advantages and disadvantages in the rental chapters.

Time Required Each Week varies on the project specifics, but we’ll make some broad generalizations, so you have a sense of the level of commitment you’ll have to make to improve your chances of success.

The Number of Monthly Interactions (e.g., how many times you visit the property or get phone calls about it) is also important to some people. They are happy spending one or two long sessions on the property but would be highly annoyed to have twenty very short interactions. Others, due to personal commitments, might have the opposite preference. We’ll help set your expectations.

Perception of Hassle varies as much by individual as it does by project, but again, we can offer some broad guidelines.

Risk Tolerance is the level of comfort that you and the key people that influence your decisions have with risk and ambiguity. If you are going to be awake at 3AM every morning worrying about this decision it may not be the right asset category for you.

Reality Check

As you read through the criteria and how they vary among the different types of real estate investments, you’ll detect a pattern of tradeoffs. For example, you can bring a lot of equity and a very strong credit score, and then purchase a large apartment building with a property manager – little effort is required on your part. Or…if you have no money and no credit, you will have to have a lot of time available and a high degree of willingness to accept hassles. There are, of course, a few options in the middle that require a degree of both. Finally, if you have great credit, lots of money, lots of skill, and lots of time to focus on the project, you are a developer – and you can focus on the very high return projects such as converting apartments to condos or scraping old buildings and putting up new ones in the most expensive neighborhoods.

Unlike late night TV infomercials, there are no reliable and ethical methods to make money with no risk, no credit, no cash, and no effort. They don’t exist in the real world. Period. Anybody who tells you different is selling something. You’ll have to bring something to the table to get a reward. Before people begin their career in real estate investing, they often think they need to have a lot of cash on hand to get started. The truth is, there are certain types of investments that will not require large sums of equity up-front.

As in anything in life, however, more cash does make things easier. Hopefully, as you progress in your investing career and build up your funds, additional investment opportunities will become available to you. The following chart will give you a summary of the equity requirements for different types of real estate investments. You can explore each type of investment in more detail in each of the following chapters.

Equity Needed

There are many potential sources for the funds. You could use your checking and savings accounts, take a loan out against your 401K, get a HELOC (home equity line of credit) if your residence has any equity, or borrow from friends and family members. We have seen clients take cash advances from their credit cards to get their funds. That is more aggressive than many investors might want to get, but it is an option. This is where evaluating your risk tolerance becomes critical.

| Investment Type | Equity requirements |

| Assignments | $0 may be possible, $10,000 – 20,000 is typical. One of the appealing attributes of Assignments is you don’t need much money or credit to play. The money is for the earnest money deposit. Alas, this tends to be the most competitive sector of real estate investing since the entry barriers are so low. You will hear about “how easy it is” from guys selling you $1,000 training packages. It’s not easy at all. |

| Rental Condo | $25,000 and up. 15-20% of the purchase price is generally required to be put down on the loan. Lenders will also require six months of operating expenses in reserves. For example, you might put 20% down on a $150k property and deposit $5k into your operating account. Three- and four-unit properties usually require 25%-30% down. Ex: Cos 1Br CND: $150K and 15% down + closing costs. Denver & Northern Co DSF: $300k and 20% down = $60k + closing costs. |

| Rental Home | |

| Small (2-4 unit) Apartment | |

| Large (5+ unit) Apartment | $150,000-$225,000 and up. Buildings over four units require a commercial loan. Sometimes a lender will loan up to 80% of the purchase price, requiring 20% down. Frequently 25-30% will be needed. You’ll need to have a few months of reserves in your operating account as well. Most new investors start with smaller rental buildings to build experience and equity. Prices for buildings will vary by market and neighborhood. Ex: Pueblo might have a 6-unit bldg. at $125k/door or $720k total. 20% down = $145k. Denver & Northern Co more likely @$150k/door or $900k total. 25% down = $225k. |

| Fix and Flips | $125,000 and up. 20% of the purchase price down is typical. Usually, the investor pays for the renovation work out of pocket. A “typical” estimate is based on a 20% down payment for a $400,000 property, a $5,000 reserve for purchase costs and holding costs, and $40,000 for renovation work. If you don’t have this much money, you may find hard money loans for projects with compelling economics. Using hard money makes it MUCH harder to make a profit. |

| Converting Apartments to Condos | $450,000 and up. Realistically you will need at least 25% of the purchase price. Some renovation work is required; the investor sometimes pays for the renovation work out of pocket. Or you could get a commercial loan for 70% of the cost (LTC, loan to cost) of the purchase + renovation. A “typical” estimate is based on a 25% down payment for a $1,000,000 property (5 units for example), $25,000 reserve for purchase costs and holding costs, $25,000 to legally divide the property, and $30,000 for renovation work per door. Quickly requires more equity for larger projects. Local banks that portfolio (don’t sell) their loans are the best sources. |

| Scrapes & New Construction | $500,000 and up. On land, plan to put down, in Denver, 50%. This only works in sought after neighborhoods, so expect to pay $700K – $1.2 million for the land. That’s $350-600K you may need to front. Engineering, survey, design, and architecture at $50,000 or more. “Hard costs” for building a luxury home in Denver in 2024 runs nearly $300 / SF. You can probably get a construction loan for the rest. Northern Colorado won’t be much less. It’d be a good idea to have some construction experience before this. |

How much equity is needed will depend on where and what you buy. The starting point to understand equity requirements is the underlying price of the asset. Then, take about 60% of that for homes and condos for LTR (long term rentals). You’ll want a rougher house in a rougher area to have cashflow. If you are interested in STR (short term rentals), you’ll need a nicer home (or plan to renovate it) in a nicer area to make it work. These are minimum guidelines; spending more for STR will usually pay off.

Homes and condos require 15% down; multifamily at the time of this writing needs 25% or more down.

Then we can solve for equity needed.

You’ll want to have six months of mortgage payments in reserve in addition to these guidelines. You could get in the game with a small LTR condo in Pueblo for $25,000. A LTR home in Denver might be more like $67,000. STR will have higher cap rates (and more work, managerially), but commensurately higher returns in many cases

Credit Score

A common misperception that new investors have is that they need to have perfect credit to invest in real estate. That is not true for all asset types – some require no credit at all, such as assignments. On the other hand, once new investors see an infomercial on TV or go to their first investing seminar, they get a perspective that they can do anything with terrible credit. That’s not true either – the truth, as usual, is in the middle.

The following chart gives you an initial idea of the relative importance of your credit score with different types of investments. The following chapters will explore this in more detail. See the Chapter on the “Where the Pros Get the Money” to see how to improve your scores.

| Investment Type | Minimum Credit Score Requirement |

| Assignments | Terrible. You won’t use your credit score for this type of investment, which makes it open to anyone! |

| Rental Condo | Average+. You’ll be purchasing the property, usually as a non-owner occupant (since you probably already have a primary residence). The mortgage companies will look at your credit score a little more closely than they will for your primary residence. As a rule of thumb, if you can qualify (even with a high interest rate) to buy a home to live in, you will be able to qualify to buy a home to rent out. However, the interest rates will be a little higher |

| Rental Home | |

| Small (2-4 unit) Apartment | Average +. The discussion for rental home and condo applies, but the standards are a little tighter when you get a slightly bigger building. |

| Large (5+ unit) Apartment | Average+ / Near Perfect. You can get a commercial loan with a credit score that is a little better than the average, but you’ll pay a higher interest rate. On larger buildings, the economics are very sensitive to your financing, so if you have just above average credit, not as many buildings will make sense for you. Conversely, if you have perfect or near perfect credit, you’ll be able to get the most favorable commercial rates which will increase the number of buildings that are economical to invest in. Most investors believe only the building matters and their credit is not considered. That is very rarely true, and never for newer investors. |

| Fix and Flips | Terrible. If you have terrible credit, you will turn to a hard money lender. They typically focus on the economics of the deal and not your credit. As a result, the number of potential investments available to you will be significantly smaller than the pool of properties available to the investor with better credit. |

| Converting Apartments to Condos | Perfect. The bank considers these to be high risk projects. |

| Scrapes and New Construction | Perfect. Very similar to “Converting Apartments to Condos.” |

As you can see, having terrible credit will not prevent you from getting involved in real estate investing, but it will reduce some of your choices and will make the choices you make less profitable than if you had better credit. Get started with a project and start learning, and in the meantime, take any steps you can to improve your credit scores. Make improving your credit score a permanent pursuit.

Experience with Contractors

If you enjoy improvement projects on the home that you live in now (or, at least, can tolerate them), you will probably enjoy working with contractors on your real estate projects. For many of our investors, this is a highly rewarding part of their work (at least when things are going right). Other investors find it very frustrating. To learn how to find a good contractor, refer to the Chapter on “How Successful Investors Build Their Team.”

| Investment Type | Importance of Experience with Contractors (or Willingness to Learn) |

| Assignments | None. |

| Rental Condo | None / Very Limited. Things will break in the rental units a little more often than they do at your home. But, if you overpay to get a deluxe contractor that holds your hand through every step of the process (e.g., go to Home Depot and hire their people), you are not going to significantly change the economics of your investment. |

| Rental Home | |

| Small (2-4 unit) Apt | |

| Large (5+ unit) Apartment | 1-2 Projects. As you buy a building with more units, you are going to have to fix more things more frequently. Getting good at managing contractors will make your building more profitable. If you don’t, you’ll leave money on the table. |

| Fix and Flips | Very Important. Experience with contractors is what will make or break your project’s profitability (and to a large extent, your enjoyment of the project, too). Even if you have at least some experiences in hiring, managing and firing contractors, this could be a great choice for you. If not, you should be willing to be actively involved to learn these skills. |

| Converting Apartments to Condos | Crucial. Don’t consider this type of real estate investing until you have mastered the management of contractors. Do some small fix and flip projects first. |

| Scrapes and New Construction | Crucial. Don’t consider this type of real estate investing until you have mastered the management of contractors. Do a few small fix and flip projects first. |

Experience with Property Managers

This table outlines the relative importance of prior experience working with Property Managers for different types of real estate investments. As you review the chart below, you will see that extensive experience with property managers is not a requirement for any of these real estate investment types. To learn how to find a good property management company, please see the chapter on “How Successful Investors Build Their Team.”

| Investment Type | Importance of Experience with Property Managers (or Willingness to Learn) |

| Assignments | None. |

| Rental Condo | None / Limited. We always advise our clients to manage their own property for at least the first year. It’s an invaluable experience. If you decide to hire a property manager, you’ll need to get some experience in managing them, but know that most investors for this size of rental manage the properties on their own. For most investors, it makes more economic sense to do it on their own and they learn many lessons firsthand that enable them to better select and manage property managers in the future on their larger investments. |

| Rental Home | |

| Small (2-4 unit) Apartment | Limited. For many investors, this is their follow-up rental investment. They often start to experiment with delegation of at least some of the property management functions in this size property. |

| Large (5+ unit) Apartment | Limited – Somewhat Important. As your rental buildings get bigger, you’ll be increasingly likely to outsource at least some of the elements of the management job. |

| Fix and Flips | None. Hopefully, you sell the property immediately after completing the renovation work. |

| Converting Apartments to Condos | Limited – Somewhat Important. Depending on the size of the building you are working in, see the discussion above. The property management elements are a bit more complex in this environment, as you may have some owners in the building alongside your tenants, with contractors improving units to the frustration of everyone. It can get a little exciting. |

| Scrapes and New Construction | None. Hopefully, you sell the property immediately after completing the renovation work. |

Time Required

Some real estate investments are relatively hands-off once they are set up and running properly. Others are very hands-on. Depending on what other commitments you are trying to juggle in your life, you may not have time for a hands-on investment. This is a common source of failure for newer investors. Don’t purchase an investment if you don’t have the time necessary to commit to it! We segment the discussion into the number of hours to get started, then the number of recurring hours of effort each week to keep the investment working well.

Here is a rough guideline to what you can expect to get your project started. The table after that will outline your time commitments after the project is started (e.g., after you close):

| Investment Type | What’s required to GET STARTED (time you invest just once, up through and including the purchase of the property) |

| Assignments | Can be extensive (60+ hours). Usually, you will start by finding a motivated seller, then negotiating the terms. Depending on the conditions in your market this can take some time. Once you have located the property you need to find an investor to match the property. Again, depending on the market, this can also take time. Once you have located all the parties there is some paperwork to fill out on a one-time basis. |

| Rental Condo | 40+ hours. You will want to spend time with your real estate agent discussing your needs, then hunt for properties, then manage the closing process. Once you close, there will be some one-time setup activities (set up checking account for building, notify tenants of new landlord and payment procedure, etc.). |

| Rental Home | |

| Small (2-4 unit) Apartment | |

| Large (5+ unit) Apartment | 20+ hours. Like the smaller rental buildings but the allocation of the time is different since you have probably purchased a rental building before. It will take less time to assess your needs, and you will probably be more efficient at finding a building. However, the changeover process once you close takes longer since there are more tenants to be managed. You’ll probably have a property management firm helping with at least some of the tasks, and they will need setup time (involving your input) to get up and running. |

| Fix and Flips | Almost always extensive (80+ hours). There are many steps to finding a good project, and the more time you invest up front the higher your chances for success. |

| Converting Apartments to Condos | Extremely extensive (160+ hours). Like the F&F project (and basically, this is a F&F project on steroids) there are many steps to finding a good project, and the more time you invest up front the higher your chances for success. |

| Scrapes and New Construction | Almost always extensive (160+ hours). There are many steps to finding a good project. The more time you invest up front, the better your chances for success. |

| Investment Type | What’s required to KEEP GOING (time you invest every week, after you close on the purchase) |

| Assignments | None. |

| Rental Condo | 0 – 3 hours / week. For the months when the property is full, you’ll just have to mow the grass, shovel snow, or deal with the occasional tenant question. If you get someone on site to do the yard work, you’ll have many weeks where you do nothing at all. When you have a vacancy, you’ll have to run an advertisement, answer some phone calls and do some showings (again, you might hire someone to do much of this for you), but it shouldn’t take too much time once you are in the rhythm of doing it. |

| Rental Home | |

| Small (2-4 unit) Apartment | |

| Large (5+ unit) Apartment | 0 – 20 hours / week. If you hire a property management company, this should be closer to zero hours. If you elect to do it on your own, it still might not be much if you have a person on-site to do yard work and show vacant units for you. If you do it all yourself, it will depend on the size of the building but will generally be among the least time intensive of the real estate investments. |

| Fix and Flips | Likely 10+ hours / week. If you have extensive contractor management experience, you can get by with a lot less. If this is your first project with contractors, you’ll want to be around frequently, and ideally getting your hands dirty, to build your skills and improve your chances of success. |

| Converting Apartments to Condos | Likely 10+ hours / week. Like the F&F discussion above, there will be a lot of work to do. |

| Scrapes and New Construction | Likely 10+ hours / week. If you have extensive contractor management experience, you can get by with a lot less. If this is your first project with contractors, you’ll want to be around frequently, and ideally getting your hands dirty, to build your skills and improve your chances of success. |

Number of Monthly Interactions

By interactions, we mean how often you will have to visit the property or take phone calls to answer questions. In addition to understanding the number of hours required to be successful, different investors have different preferences for the number of interactions they will need to have. Due to the balancing act of work and family, some prefer to have a smaller number of longer interactions, while others prefer many interactions of shorter duration. Which do you prefer?

| Investment Type | Typical number of monthly interactions (e.g., phone calls, meetings, on-site visits) |

| Assignments | None. |

| Rental Condo | Average 1 – 5. Should not require much ongoing effort for the months when the unit is occupied; more effort when you are filling a vacancy, less if you have management assistance. Most of the interactions will be very brief (e.g., following up on why rent is late, answering questions about a vacant unit). |

| Rental Home | |

| Small (2-4 unit) Apartment | Average 1 – 10. Like “Rental Condo” above, but you will have vacancies more frequently. |

| Large (5+ unit) Apartment | Average 1 – 20+. Like “Small Apartment.” If you hire out all the property management, it can be relatively easy. You’ll have some longer discussions with your property manager on a monthly “status call.” |

| Fix and Flips | Average 10 – 20+. If you are not experienced, you will want to check in at least several times a week with each major contractor on the team. Many of these interactions will be longer discussions (10+ minutes) as contractors explain problems that have appeared, and you discuss alternative options to resolve the issue and select the best approach. You’ll probably want to be on site frequently. You might also lower your project costs by buying materials for the contractors and delivering them to the job site, which can be time consuming. |

| Converting Apartments to Condos | Average 20+. This is a combination of running an apartment building with a F&F at the same time; anticipate lots of phone calls. There will be plenty of longer phone calls and meetings to resolve problems, and you will work with attorneys on the HOA documents, etc. Not for the faint of heart. |

| Scrapes and New Construction | Average 5 – 10. If you hire a general contractor to oversee the project, they will be responsible for handling most of the phone calls and resolving most of the problems. If you want to be the General Contractor, then you have a new part time job. |

Perception of “Hassle”

This is the toughest area to assess – what annoys one investor might be a challenging and fun puzzle to solve for the next. Look within yourself. We’ll discuss how to manage some of the most common hassles later in the book. Specifically, how to select and manage contractors is covered in the chapter “How Successful Investors Build Their Team”, and working with tenants is covered in the chapter “Property Management.” However, there are some broad observations we can share:

| Investment Type | How Much Hassle is Required |

| Assignments | High – Very High. If you don’t bring a credit score or cash, you are going to have to bring your time and willingness to deal with a lot of nonsense to find a good deal. The seminars and infomercials make it sound easy, but most people find it’s more hassle than it’s worth. Consider yourself warned. |

| Rental Condo | Very Low – Moderate. People are people and tenants are tenants. Most are fine but some will drive you crazy. You will have the occasional person that never pays on time, irritates other tenants, or is the one complaining about every possible issue. Hopefully it is the exception and not the rule. Unless you are in a dreadfully bad renter’s market, keeping your building occupied usually will not be too much of a problem if you work hard and pay attention. This is not, however, a turnkey business. See the chapter on “Property Management” to learn more. |

| Rental Home | |

| Small (2-4 unit) Apartment | |

| Large (5+ unit) Apartment | Very Low – Moderate. Most investors don’t buy a larger building until they have some experience with a smaller building for a very good reason. They’ve already learned many lessons on tenant selection, and hopefully how to get a property manager to help them. A good property manager will make this score “very low.” If you do a lot of the work yourself, you’ll make more money, but you’ll have more headaches, too. |

| Fix and Flips | Before closing on purchase: Medium – High. You will want to do a lot of due diligence (e.g., verifying all the facts that the listing agent gave you that you relied on to decide) to avoid making a mistake. This takes time. After closing to completion of renovation: Medium (if you have experience) – Very High (if you do not have experience). This can be a great way to build equity in a hurry, but it would be misleading for us to tell you that it’s a walk in the park. It can be a lot of fun for the projects where everything goes well (and this does happen), but most projects will involve at least some headaches. |

| Converting Apartments to Condos | Very High. Like the “Fix and Flip” discussion above. |

| Scrapes and New Construction | Before closing on purchase: Medium – High. You will want to do a lot of due diligence to avoid making a mistake…this takes time and the discipline to walk away from projects that don’t make sense. After closing to completion of renovation: Medium (if you hire a general contractor).Very High (if you are the GC). This can be a great way to build equity in a hurry, but it would be misleading for us to tell you that it’s a walk in the park. It can be a lot of fun for the projects where everything goes well (and this does happen), but most projects will involve at least some headaches. |

Risk Tolerance

“Courage is resistance to fear, mastery of fear – not absence of fear.” ~ Mark Twain

Some investors (and their spouses and/or co-investors and/or bankers) are more comfortable with risk and ambiguity than others. This chart will give you an initial orientation to the degree of risk you are accepting with different types of real estate investments.

| Investment Type | Relative Degree of Risk and/or Uncertainty |

| Assignments | None. |

| Rental Condo | Very Low. This investment is relatively easy to assess, purchase, and sell if you don’t like it. A small condo is probably the easiest category of rental to manage. Like all rentals, the returns are predictable and are not too volatile. |

| Rental Home | Low. Like rental condo, only you’ll have to plan for outside maintenance on your own. On the other hand, you won’t have HOA fees, noisy neighbors, etc. |

| Small (2-4 unit) Apartment | Low. Less risky than rental condos and homes since you have more than one unit, so it’s unlikely you would ever have to make a mortgage payment completely on your own. A little riskier than a condo or rental home since it (typically) costs more to purchase and might take a little longer to sell. |

| Large (5+ unit) Apartment | Low – Medium. Less risky than other rentals insofar as the cashflow should be the most stable of any rental group. More risky than other rentals since they cost more, require more equity, and take longer to sell. In the hands of a landlord seasoned with experience from smaller buildings there’s a relatively low degree of risk. Returns are certainly more predictable and controllable than the stock market. |

| Fix and Flips | Medium – High. High risk, high effort, and high potential return. Requires more due diligence up front than rental investments. Your success is largely dependent on the performance of your contractors who you do not directly control. Be careful. Work with pros. Consider the risks. |

| Converting Apartments to Condos | High / High+. All the factors for an apartment building and a Fix and Flip. |

| Scrapes and New Construction | High. High risk, high effort, and high potential return. Just like Fix and Flips, and then some. |

What Kind of Active Real Estate Investors Am I Quiz!

Which Investing Category is Best for Your Unique Situation?

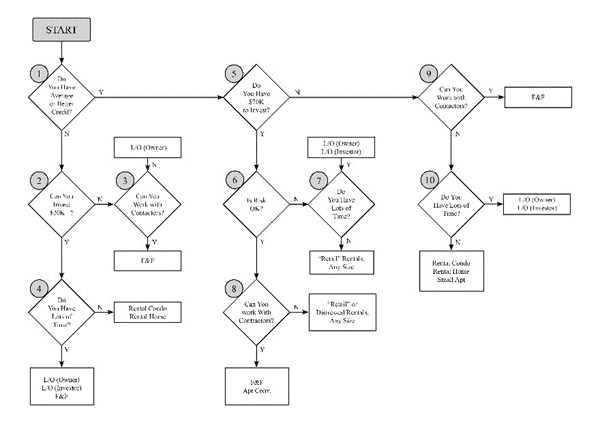

Follow the ten questions to determine which real estate investing categories are best suited for your unique situation. Take your time – the better you reflect on this now, the fewer mistakes you will make later.

Question 1: Do you have average or better credit? We will explore credit scores in exhaustive detail in the chapter “Where the Pros Get the Money.”

- If your credit score is below 620, you have poor credit.

- If your score is above 660 assume you have average credit.

- If your score is above 720, assume you have excellent credit.

If your score is above 660, the answer is yes, proceed to question 5. If not (your score is below 660), go on to question 2.

Question 2: Can you make an investment of at least $25K? If the answer is no, go to question 3. If yes, go to question 4.

Question 3: In this case, you currently do not have a strong credit score and you are limited to the funds that you can invest. Do you enjoy (or at least are willing to try) working with contractors?

- If you are not willing to work with contractors, you should consider Assignments.

- This will get you started while you rebuild your credit and save up a downpayment.

- If you are willing to work with contractors, you can consider a consider a fix and flip project.

- You will need to get a Hard Money loan that finances both acquisition and repair costs.

- You need almost 100% financing. That is rare; you’ll need an exceptional deal, which will take a lot of time to find.

- Since the project funding will be tight, you will probably have to do a lot of the work yourself.

- However, this could be a good method for you to build your equity reserves in a hurry if your marketplace currently has a good market for F&F.

- This is a high intensity sweat equity project!

Question 4: Do you have a lot of time on an ongoing basis to allocate to your real estate investing interests?

If you do not have a lot of ongoing time, then you should consider getting a small rental property. With your current cash resources and credit score, you will most likely want to choose a rental condo; a rental home is likely out of your budget.

- You could get a 1BR condo rental for $100K or less in Pueblo, CO, so your cash investment could be at/under $25K.

- The cheapest 1BR rental condos in Denver are closer to $200K, so you’d need closer to $50K in cash for down payment and perhaps another $10K in reserves.

- You can adjust this for the market prices in your target market.

As you build equity in a few years, you can refinance your property and you will have more capital to deploy. Also focus on building your credit score, and this will serve to increase the options that are available to you.

If you do have a lot of ongoing time to invest, you have more choices. You can choose to pick a smaller rental as outlined above, or if you like working with contractors (or have the desire to learn), you could work on a small fix and flip.

- If you choose a F&F, you will likely need to get a Hard Money loan that finances the acquisition costs and the repair costs.

- Since the project funding will be tight you will probably have to do a lot of the work yourself.

- However, this could be a good method for you to build your equity reserves in a hurry if your marketplace currently has a good market for F&F.

Question 5: We have established that you have at least an average credit score. Do you have at least $70,000 to invest? If not, please jump to question 9. If you do have at least $70,000 you would like to invest, continue with question 6.

Question 6: Are you willing to take on at least a moderate level of risk to get higher returns? If yes, and you want to focus on the higher risk opportunities to earn higher returns, please skip to question 8. If you want to start with less risky investments and are accepting lower returns, continue to question 7.

Question 7: We have established you have a good credit score, at least $40,000 to invest, but you want to limit your risk. Do you have a lot of time to invest with your real estate investments on an ongoing basis?

If you do not have much time, then a rental strategy is probably best for you.

- If this is your first time as a landlord, you’ll want to start small.

- You can afford a condo, home, or small apartment building.

- Condos and homes require less money, but they have more cashflow volatility (e.g., if the tenant moves out you make all the mortgage payment).

- Slightly larger buildings will require a little more money, but the cashflow is more dependable (if one of the four tenants moves out, the other three tenants will pay most or all the mortgage for you).

If you have some experience as a landlord, you should consider a larger (more than five unit) building.

- With your experience, this will also be a low-risk investment, and with a competent property manager it won’t take too much of your time either.

- In any case, you will probably want to purchase a building without a lot of risks (e.g., not many vacancies, in a nice part of town, and/or not much deferred maintenance) to reduce your exposure.

Question 8: We have established you have a good credit score, at least $70,000 to invest, and you are willing to accept more risk to get more return. Are you experienced working with contractors?

If you are not experienced but are willing to learn, a fix and flip project would work.

- You will not have the constraints that a Hard Money lender will often apply to applicants with less credit power.

- You will have the financial freedom to hire contractors to do the work and not have to do most of the work yourself.

- If it is your first F&F project, start with something simple even if you can take on more risk. Don’t be a hero to start!

- Once you have had a successful project, move on to more complex projects. Walk before you run, and you won’t be a statistic!

If you are experienced with contractors, you should consider whether an apartment conversion (if the market cycle is right) or a scrape and new construction is right for you. This is the highest risk category, but it also can have the highest returns and affords considerable tax planning flexibility that the other investment choices do not offer.

If you have strong credit, ample cash, and willingness to take on risk, but you don’t want to deal with contractors, your best choice may be to buy a rental building. (We will explore the difficulties of working with contractors later in the book).

- If you don’t have much property management experience (either first-hand or managing the managers), buy a less ambitious project (e.g., a “retail” building), learn about how to manage a building, and then in the future, consider a more difficult project (e.g., a “distressed” building).

- If you do have property management experience, you could consider buying a distressed building that is being sold below market. Many rental investors do not have deep property management skills, so you won’t be competing with as many people for the investment, thus you can often get a better price. Examples of factors that cause distress are high vacancy rates, significantly deferred maintenance, and/or weak property management (often manifested as below-market rents). Since buildings usually sell as a multiple of cashflow, you can buy the under-performing building at an attractive price, fix the issues causing distress, then re-sell the building at a higher price. This is a great strategy if you have the time and inclination to do it!

Question 9: You have at least an average credit score, but you have less than $70,000 available. Do you enjoy working with contractors? Or are you willing to try?

- If not, proceed to question 10.

- If you are willing to work with contractors, you should consider a fix and flip project.

- You will not have the constraints that a Hard Money lender will often apply to applicants with less credit power, and you will have the financial freedom to hire contractors to do the work.

- If it is your first F&F project, start with something simple even if you are willing to take on more risk.

- Once you have had a successful project, move on to more complex projects.

Question 10: You have at least an average credit score, you have less than $70,000 to work with and you don’t want to duke it out with your contractor every Friday afternoon. Do you have a lot of time, on an ongoing basis, to allocate to your real estate investments?

If you do not have a lot of ongoing time, then you should consider getting a small rental property.

- With your current cash resources, you will most likely want to choose a rental condo, a smaller rental home or a small (2- 4 unit) building.

- As you build equity in a few years, you can refinance your property, and you will have more capital to deploy.

If you do have a lot of ongoing time to invest, you have more choices.

- You can choose to pick a rental as outlined above.

- You could choose to pursue a lease option strategy. That doesn’t work well in this market, but it might be an option in the future.

Summary. This post requires a great deal of self-analysis, a discipline which does not come naturally to many of us. We suggest you return to the beginning of the post and walk through the flowchart again…slowly and deliberately…with someone you trust. It’s critical you spend the time to get this right. Otherwise, you risk pursuing the wrong type of real estate investment and severely reducing your chance of success.

If you and your family are honest, none of these active paths might be a good match. If that is the case, passive real estate investing is likely the path to take.

If you are ready for passive, diversified investing…without the headaches, book your 15min investment review at https://irontoncapital.com/myreview to see if we can help you go passive.